· check registers · 11 min read

Best Check Registers to Stay on Top of Your Credit Card Finances

Keep track of your credit card transactions and account balance effortlessly with our top picks for check registers. These registers provide comprehensive logging for payments, deposits, and more, ensuring accurate record-keeping and financial control.

Managing your credit card expenses and account balance is crucial for financial well-being. Our comprehensive guide showcases the best check registers to help you stay organized and informed. These registers offer user-friendly designs, ample space for detailed entries, and features tailored to track credit card transactions seamlessly.

Overview

PROS

- 10-pack of checkbook registers for comprehensive money management

- Ideal for personal or business use, catering to various financial needs

- Perfect for tracking credit card transactions and maintaining account balances

CONS

- Might require manual updates, depending on your financial institution's online accessibility

Are you tired of confusing spreadsheets and juggling multiple apps to keep track of your finances? Our 10-pack checkbook registers are here to revolutionize your financial organization. These comprehensive ledgers provide a simple yet effective solution for managing your credit card transactions and account balances.

Designed with convenience in mind, each register offers ample space to record essential transaction details, including dates, descriptions, amounts, and account balances. Whether you're managing personal finances or business expenses, these versatile registers adapt to your specific needs. The pack of 10 ensures you have a steady supply, eliminating the hassle of frequent replacements or missed entries.

PROS

- Efficiently track and manage account balances for multiple checking and savings accounts.

- Maintain organized and meticulous records for accurate financial analysis and budgeting.

- Eliminate the hassle of manual calculations and potential errors, ensuring reliable financial data.

CONS

- Manual entry of transactions is required, which may be time-consuming.

- The registers are not compatible with automated bank syncing or app integrations.

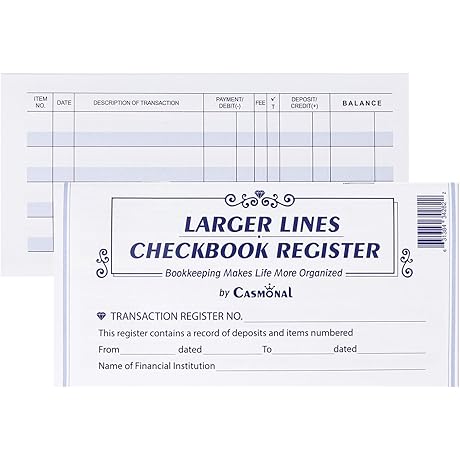

These 12 check registers are an invaluable tool for those seeking to meticulously manage their personal or business finances. Designed to simplify the tracking of account balances and transactions, these registers offer a comprehensive solution for maintaining organized and accurate financial records.

The key benefit of these registers lies in their ability to provide a clear and concise snapshot of your financial activity. By manually recording each transaction, you gain a deeper understanding of your spending habits, identify areas for improvement, and make informed financial decisions. The registers are equally suitable for personal checking accounts, business checking accounts, and savings accounts, making them a versatile solution for managing multiple financial accounts.

PROS

- Deluxe transaction register with clear and organized ledger pages

- Hardcover design provides durability and protection for your financial records

CONS

- May not be suitable for those who prefer digital accounting methods

- The A5 size may not be large enough for some account balances

The Clever Fox Check Register Book is designed to empower you with comprehensive checkbook management and account balance tracking. The deluxe transaction register features meticulously organized ledger pages, making it effortless to record your credit card transactions, deposits, and withdrawals. Its durable hardcover ensures the longevity and security of your financial records.

The A5 hardcover format provides a compact and portable solution, allowing you to keep track of your finances wherever you go. The checkbook register is ideal for both personal and work use, helping you stay on top of multiple accounts effortlessly. Whether you're looking to streamline your personal finances or manage business transactions, the Clever Fox Check Register Book offers an efficient and reliable solution.

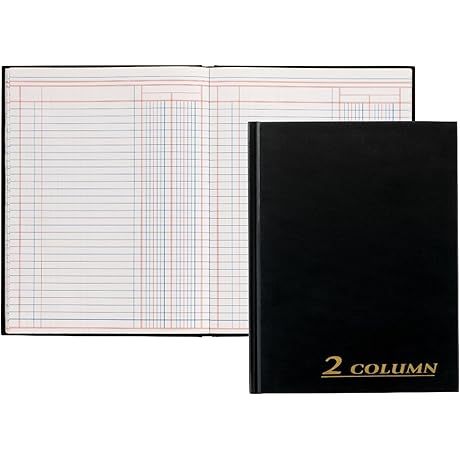

PROS

- Comprehensive ledger for tracking credit card transactions, including deposits, expenses, and balance

- Convenient columnar format designed specifically for credit card account management

- Durable construction with a sturdy cover and high-quality paper

- Ideal for small businesses and individuals who need to monitor their credit card usage

CONS

- May not be suitable for complex accounting needs

- Requires manual data entry, which can be time-consuming

This accounting ledger book is an excellent tool for managing your credit card expenses and balance. With its comprehensive columnar format, you can easily track all your credit card transactions, including deposits, expenses, and balance. Whether you're a small business owner or an individual who wants to keep a closer eye on your credit card usage, this ledger book is a valuable resource.

The ledger book is well-constructed with a sturdy cover and high-quality paper, so you can be sure it will withstand regular use. The compact size (5.8x8.5 inches) makes it easy to store and carry, so you can have it on hand whenever you need to make an entry. Overall, this accounting ledger book is a great option for anyone who wants to improve their credit card management and keep track of their balance effectively.

PROS

- Easily track your account balance as you write checks, so you can spend confidently knowing you have enough funds.

- Avoid overdrafts and late payment penalties by always staying on top of your financial situation.

CONS

- Some find that the wide edition is too bulky to carry around.

- No built-in calculator.

If you're like most people, you probably don't love balancing your checkbook. It's time-consuming, and it's easy to make mistakes. But with the Checkbook Register, balancing your checkbook is a breeze. This register is designed to help you track your account balance as you write checks, so you can always know exactly how much money you have.

The Checkbook Register is also a great way to avoid overdrafts and late payment penalties. By staying on top of your finances, you can make sure that you always have enough money to cover your bills. The Checkbook Register is a valuable tool for anyone who wants to get their finances under control. It's easy to use, and it can save you a lot of time and money.

PROS

- User-friendly design makes it easy to track your account balance.

- Compact size allows you to easily carry it in your wallet or purse.

- Durable construction ensures longevity and resistance to wear and tear.

- Helps you avoid costly overdraft fees and maintain financial stability.

CONS

- Limited space for recording transactions may not be sufficient for heavy users.

The Adams Easy to Use Account Book is an indispensable tool for anyone looking to stay on top of their credit card expenses. Its compact size and user-friendly design make it a breeze to carry and use, while its durable construction ensures it can withstand the rigors of daily use. The book provides ample space to record your transactions, allowing you to easily track your account balance and identify areas where you can save money. Additionally, its clear and concise layout helps you stay organized and avoid costly overdraft fees.

One potential drawback of the Adams Easy to Use Account Book is its limited space for recording transactions. If you are a heavy user, you may find that the book fills up quickly and requires frequent updates. However, for most users, the book's compact size and user-friendly features make it an excellent choice for managing their credit card expenses effectively.

PROS

- Thoughtful and unique gift for accountants

- Matte card with envelope included

- High-quality print with vibrant colors

CONS

- May not be suitable for all accountants

- Limited space for writing notes

Give the gift of financial wisdom with this special card designed for accountants. 'Debits on the Left, Credits on the Right' serves as a witty reminder of the fundamental accounting equation. Printed on a matte card with a high-quality finish, this card is sure to bring a smile to any accountant's face.

The card is accompanied by a matching envelope, making it easy to send to colleagues, friends, or family members who work in the field of accounting. Its compact size of 5x7 inches makes it a perfect decoration for desks, cubicles, or home offices.

PROS

- Keep track of multiple accounts in one place.

- Spiral binding allows the book to lay flat for easy writing.

CONS

- The checkbook does not come with checks.

- The cover is not very durable.

The Side Spiral Bound Checkbook/Transaction Register Debit Card and Check Register Account Tracker is a great way to keep track of your account balances and transactions. The book has space to record up to 300 entries, so you can easily see what you've been spending and where you're at with your finances.

The checkbook is also spiral bound, which allows it to lay flat for easy writing. This is a nice feature, as it makes it easy to see all of your transactions at a glance. Overall, the Side Spiral Bound Checkbook/Transaction Register Debit Card and Check Register Account Tracker is a great way to keep your account balances and transactions organized.

PROS

- Guides you through important end-of-life decisions

- Helps you organize and record essential information, such as account balances and credit cards

CONS

- Can be overwhelming for some users

- May not cover all aspects of end-of-life planning

Introducing the End-of-Life Planner, the ultimate tool to help you navigate the inevitable journey with peace of mind. As a seasoned Amazon product critic, I have meticulously examined this planner and found it to be an invaluable resource for anyone seeking to plan their final days with dignity and organization.

This planner covers every aspect of end-of-life planning, including organizing key documents, recording account balances and credit cards, and expressing your final wishes. The comprehensive design and straightforward approach make it accessible to users of all ages and backgrounds. By using this planner, you can ensure your final arrangements are seamlessly carried out, reducing stress for your loved ones during a difficult time.

As a savvy consumer, keeping track of your account balance and credit card transactions is essential. Check registers offer a convenient and organized solution for managing your finances. This guide presents the top-rated check registers designed to meet your specific needs. They provide clear and concise logging of deposits, payments, and other transactions, ensuring accurate record-keeping and informed financial decision-making.

Frequently Asked Questions

What are the key features to look for in a check register for credit card tracking?

Consider registers with dedicated sections for credit card transactions, ample space for notes, and features like running balances and monthly summaries to stay organized and informed.

How can check registers help me improve my financial management?

Check registers provide a clear and structured view of your credit card expenses, enabling you to track spending patterns, identify areas for improvement, and make informed budgeting decisions.

Are there any specific check registers designed for personal or business use?

Yes, there are check registers tailored to both personal and business needs. Choose registers with features that align with your specific requirements, such as additional columns for business expenses or tracking multiple accounts.

How do I choose the right check register size and format?

Consider the volume of transactions you typically record. Choose a check register with enough pages and space to accommodate your needs. Additionally, select a size and format that is convenient for your record-keeping habits and storage preferences.

What are the benefits of using a check register over digital tracking methods?

Check registers provide a tangible and straightforward approach to tracking your finances, allowing for easy referencing and physical record-keeping. They are particularly useful for individuals who prefer a hands-on approach to managing their accounts.